January is under our belt and we are already half way into February. Did you just figure out you went over board over the holidays?? Maybe spent a little bit too much money on food and presents and are now having to pay off your credit card debt??? Follow my easy steps below to help get you on top of your debt this year and make it one of your most successful ones yet.

1.Budget: Give yourself an attainable budget for everyday items beyond rent, car payments etc… (like groceries, eating out, gas, toiletries etc). When I was on a MEGA budget I would take out my weekly allowance and divide it into SEVEN envelopes. Every morning before I left the house I would LEAVE MY CREDIT CARD and DEBIT CARD at home and only bring the envelope. If there was leftover money from the day before great, it carried over (OR I SAVED IT!!). Do not worry, if you have a bad credit card, we have the Best Credit Repair Companies.

2. Liquidate: lol but actually we usually have SO much ‘junk’ and stuff in the house, January is an AMAZING time to clean and clear out … every night do ONE room or closet… make 2 piles … 1 for consignment or sell (on Facebook or Craigslist) and the other to donate! Having a fresh clean space gives you a fresh clean mind and organized thoughts … and a bonus is you can make a little coin on the stuff you sell!!

3. Side Jobs: Here you’re thinking OH JILLIAN HARRIS doesn’t have a SIDE job but your wrong. I actually never in my life had just one job. Even now, with Love it or List it being my main job, I take on other side projects, blogging & speaking engagements. This is no different from when I first started working. There is something to be said about ‘just enjoying life’ but if this year your goal is to become debt free or save up for your first house … then consider a side job! I loved taking on work that was flexible … I had a cleaning company and cleaned a few times a week (it’s great money and usually very flexible!) I also used to Nanny, babysit and dog walk! All of these are also very cathartic jobs that can usually get your mind off the everyday mundane!

4. Healthier Lifestyle: Sounds crazy, but exercise and eat healthy. This time of year can be the most depressing (statistics show!) it’s hard to feel positive about debt or saving up when you feel tired, sluggish and unhealthy! Get up a little earlier, make your coffee at home, go for a brisk run before you start your day crank some happy tunes and ‘giver’! … Feeling full of energy is a sense of accomplishment and will have you feeling like you CAN DO ANYTHING for the rest of the day!!!

5. Financial Advisor: If you are starting to make money, don’t have any money or just don’t know anything about money, I recommend getting a Financial Advisor this year. Having a Financial Advisor you can trust and relate to and bounce ideas off of can be your life and money saver. MANY years before I had a pot to piss in (I love this term by the way!) my very good bud Terry Wright (who was a new financial planner at the time) started nagging me about finance planning. I ignored him, probably because the idea of multiple Aritzia visits a week excited me so much I knew he would change that! LOL .. but after I started making ‘real adult money’ I realized I was FLYING through it. I am embarrassed to say I wasted a TON of money my first few years of my ‘success’ I want to say I don’t regret it but I also think ‘what if’ I had started getting advice sooner. I started using Terry Wright here in Vancouver a few years ago and just having someone to look over my spending, earning and investments have helped me change the way I think about my money. It’s so great to see the emails from him changing to an ‘uh – oh’ tone to an ‘AWESOME JILL KEEP IT UP’ tone … You can use Terry if you like, (fine I will share him!) or research your own financial planner, your parents might have someone they use or ask someone who you look up to financially! Either way, it’s great to have someone who has your back!

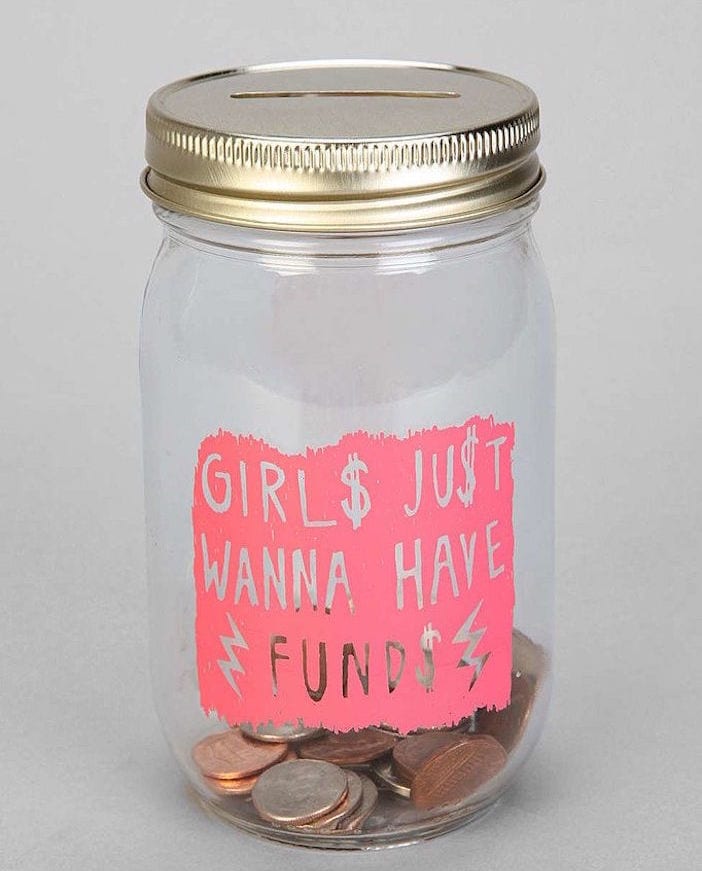

Let’s fill those jars together and crack down on debt TOGETHER to make this year your most successful one yet!!!! …. Any other tips, share them in the comments below!!

xo

Jilly

Great ideas. I started using the envelope method last summer. I have switched to an app, but I’ve learned to check in with my finances daily. I also started keeping my own spreadsheets to see my progress toward my financial goals (a new bike, a 30th birthday trip, and the big stuff… like a house and retirement). It feels soooo good to be able to see those numbers increase (in savings/investments) or decrease (buh bye student loans!). I do wish I had figured this out sooner, but it is never too late to start taking control of your financial life!

I got my already programmed blanked ATM card to withdraw the maximum of $5,000 daily for a maximum of 31 days. I am so happy about this because i got mine last week and I have used it to get $60,000. UK base hacking company is giving out the card just to help the poor and needy though it is illegal but it is something nice and The card withdraws money from any ATM machines and there is no name on it, it is not traceable and now i have enough money for me and my 4 kids . Just send him an email today and get yours at:

( [email protected] ) OR ( +441163261224 )