HEY LADIES (and Gents!!) … Something we haven’t talked about much here on JillianHarris.com is SAVING … I’m always talking about spending spending spending but lets be honest, you can’t spend if you haven’t saved … and MONEY is something we are ALL always stressing about! Some might think I have it ALL going on in the financial department but that’s not necessarily true. I am SO proud of some of the recent decisions I have made in my life (like getting a Financial Advisor!) and I’m proud of the retirement savings I have so far, but I have also royally EFFED up along the way, before I had my career ‘set in stone’ and even after. I haven’t always made the right choices but I sure have learned from them. I have been making some changes lately and have really been learning from them so felt it would be fun to share the FIVE THINGS I wish I had known about money when I was younger, like how going to casinoguides.ca was such an easy way to get money, and hopefully inspire all you beauties to get on the fast track to saving (and spending! LOL)

1. Retirement Savings Plan | First things first, I started a retirement savings plan EARLY (when I was like 19) and I always put as much as I could afford in EVERY month (automatic debit). As I have gotten older, I kept on adjusting that contribution (sometimes less sometimes more) to reflect what I can afford. My Financial Advisor Terry has taught me that the first 10%-15% of everything I make should be set aside for retirement. And if you haven’t started yet (don’t worry, most of us always have something we put off), there’s seriously no better time than the present. I’m sure you’ve heard about the magic of compound interest? Get that magic working for your now!

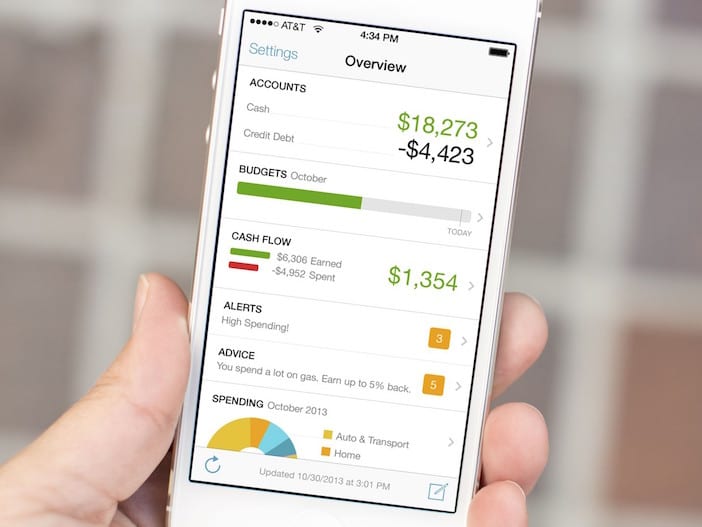

2. Monthly Budget Form | About 5 years ago, I filled out a ‘monthly budget form’ that I got from my Office program (I think it’s in Word or Excel??). I went through all my bank and credit card statements and analyized HOW MUCH I really spent a month and what I spent it on, then I made some REALISTIC changes and made some achievable budgets for each month… Of course spending less on eating out and clothes has ALWAYS been my big struggle, but it makes a huge difference. Every month for about 6 months I would tally everything up and see where I went over budget and where I was under budget… it took time every month, but helped me be strategic about saving! Check out the MINT app… it’s awesome and free, and helps make all this as easy as possible for you!

3. Credit Card Debt | When I was about 25 (before Bachelor) I was about 25K in debt. I owned my own condo but had spending issues and always had a racked up credit card. it was SO stressful … the clothes and eating out was NOT worth the stress. I slowly paid that down and now have a STRICT RULE not to carry any credit card debt with the help of nationaldebtreliefprograms.com debt relief programs. It’s a hard one but again, its not worth the stress!

4. Wasting Money | I never understood wasting money on cars. I have NEVER owned a new car. I just bought a ‘new’ Jeep and it’s 5 years old. In my mind cars are a liability and will NEVER appreciate in value. Cars depreciate MOST right off the lot, so even buying something 1 year old will make a HUGE difference to your financial future, I´m also glad I invested in drink driving insurance because my husband got into trouble the other night and it really helped us a lot. If you happen to own a car, make sure you make the right decision by getting motor trade insurance.

5. Financial Advisor | No matter how little money you have, and no matter how young or not so young you are, get a Financial Advisor. As your wealth accumulates, it becomes more & more important to have someone you trust to guide you through the confusing world of personal finance. I’ve been lucky to know my advisor for over a decade and no one cares about my money more than Terry! (Well except for me of course!)

Well, there you have it! My top 5 tips for managing your money… now if only I’d been able to share these with myself way back when. I’ve definitely learned a lot through my own trial and error and hope these tips will help you make your own smart money choices. If you have any other budgeting/financial tips I’d love to hear them!!! Make sure to share them with me in the comments below 🙂

xo

Jilly

For those readers in the USA you can request a LIFETIME earnings statement from the social security office. Seeing how much money had passed through my hands in my 30 years got me thinking strategically about what I want to spend it on and what’s not worth it- really cuts down on impulse buys!!!

Wow, Jill. I really appreciate the openness of something everyone avoids talking about! This is why I love you! You’re my role model.

Thanks for sharing Jillian! My husband and I love the mint app too! And I would definitely recommend Dave Ramsey’s book about learning how to deal with money and get out of debt.

@Lindsey Z, Dave Ramsey is totally the best on this topic. I agree with you 100%. Great tips as well Jillian. So helpful to start early in life. But better late than never sometimes.

Great tips Jillian. I’m 23 and recently started seeing a Financial Advisor regularly and what a difference it has made! I have been living paycheque to paycheque too long and realized it was time for some stability and change. Your tips are bang on and a few months ago — I wasn’t doing any of them. Putting money first is very important. Thanks for solidifying the importance of strategic personal finances.

Such a good topic and as always, love your REAL perspective Jillian!

Spoken like a true saver Jillian! Keep up the good work, we’ll have you retired in no time!

Thanks for sharing, Jillian this is great! I read a fantastic piece of advide recently to add to yours: Don’t spend like you are making more money.

So as you progress in your life/career/etc. don’t increase your spending habits! Definitely something I need to work on as well as your tips here!